“Risk is an inevitable part of life, and business is no exception. Every day, organizations face numerous uncertainties that can impact their success. But, what if you could turn these risks into opportunities? Effective risk management is the key to unlocking this potential. It’s a game-changer that can help you navigate uncertainties, make informed decisions, and achieve your goals. In this article, we’ll delve into risk management, exploring its definition, importance, and how it can be a powerful tool for success. So, let’s dive in and discover the art of managing risk!” ISO 31000

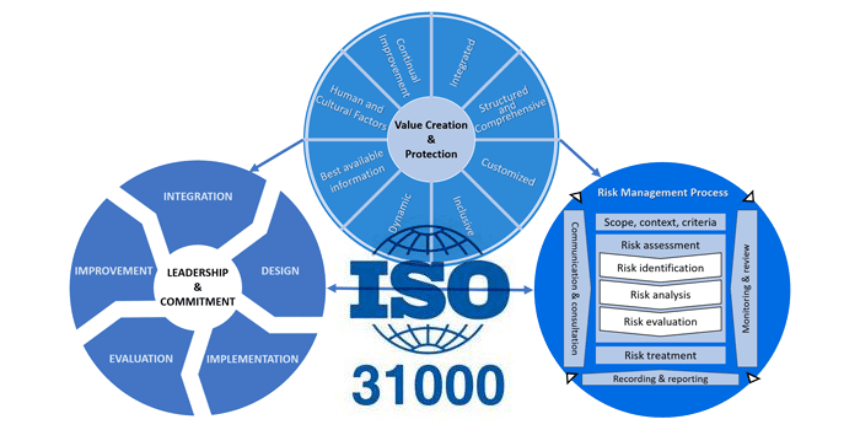

Understanding ISO 31000: Overview of the Standard and its Principles

Imagine you’re planning a family road trip from Karachi to Lahore. You’ve got your route mapped out, but you know that unexpected events like traffic jams, car troubles, or even a sudden rainstorm can throw a wrench in your plans. That’s where risk management comes in – exactly what ISO 31000 is all about!

ISO 31000 is an international standard that provides a framework for managing risk in any organization, big or small. It’s a set of guidelines that help you identify, assess, and mitigate risks, so you can achieve your objectives with confidence.

The standard is built around 11 principles that are designed to be flexible and adaptable to any organization’s needs. These principles include:

- Risk management is an integral part of all organizational processes

- Risk management is a continuous process

- Risk management is tailored to the organization’s context

- Risk management takes a structured and systematic approach

- Risk management is based on the best available information

- Risk management is transparent and inclusive

- Risk management is dynamic, iterative, and responsive to change

- Risk management is capable of continual improvement

- Risk management is aligned with the organization’s objectives

- Risk management considers human factors

- Risk management is integrated into the organization’s governance

Let’s break it down with an example. Say you’re the CEO of a small business in Lahore that specializes in event management. You’re planning a large wedding reception for 500 guests. Using ISO 31000 principles, you would:

- Identify potential risks (e.g., venue availability, catering, weather)

- Assess the likelihood and impact of each risk

- Develop mitigation strategies (e.g., book a backup venue, have a contingency plan for catering)

- Continuously monitor and review the risks and mitigation strategies

By applying ISO 31000 principles, you can minimize the likelihood of things going wrong and maximize the chances of a successful event. And that’s just one example – the standard can be applied to any organization, in any industry, anywhere in the world!

Establishing the Risk Management Framework: Setting the Foundation

Meet Amna, a talented entrepreneur who’s just launched her dream startup, a small café in Islamabad. She’s passionate about serving the perfect cup of coffee and creating a cozy atmosphere for her customers. However, Amna knows that her business is not immune to risks. What if a competitor opens a similar café across the street? What if there’s a sudden rent increase? What if an employee accidentally causes a fire in the kitchen? ISO 31000

To mitigate these risks, Amna needs to establish a solid risk management framework. This is where ISO 31000 comes in – providing a structured approach to risk management that’s tailored to her café’s unique needs. ISO 31000

Step 1: Define the Risk Management Framework

Amna starts by defining her risk management framework, which includes:

- Risk management policy: A statement that outlines her commitment to risk management and sets the tone for her café’s risk management culture.

- Risk management objectives: Specific goals that align with her business objectives, such as ensuring customer safety and maintaining business continuity.

- Risk management scope: A clear definition of what risks she wants to manage, such as operational, financial, and reputational risks.

Step 2: Identify Risk Management Roles and Responsibilities

Amna identifies the key players in her risk management team, including:

- Risk owner: Herself, as the business owner, who is ultimately responsible for risk management.

- Risk manager: Her operations manager, who’ll oversee day-to-day risk management activities.

- Risk team members: Her employees, will be responsible for implementing risk mitigation strategies.

Step 3: Establish Risk Management Processes

Amna sets up processes for:

- Risk identification: Regularly brainstorming and documenting potential risks.

- Risk assessment: Evaluating the likelihood and impact of each risk.

- Risk mitigation: Implementing controls and strategies to reduce or eliminate risks.

Identifying and Evaluating Potential Risks: The Heart of Risk Management

Meet Fahad, a seasoned project manager at a software development company in Karachi. He’s leading a team to develop a cutting-edge mobile app for a major client. Fahad knows that his project is exposed to various risks, and he wants to ensure that his team is prepared to handle them. ISO 31000

Risk Identification: Brainstorming and Discovery

Fahad gathers his team for a risk identification session. They use techniques like brainstorming, mind mapping, and SWOT analysis to uncover potential risks. Some of the risks they identify include:

- Technical risks: Delays in development, software bugs, and integration issues.

- Schedule risks: Missed deadlines, scope creep, and resource allocation challenges.

- Financial risks: Budget overruns, unexpected expenses, and revenue shortfalls.

- Operational risks: Data breaches, system downtime, and supply chain disruptions.

Risk Evaluation: Assessing Likelihood and Impact

Fahad’s team evaluates each risk using a risk matrix, assessing both the likelihood and potential impact of each risk. They consider factors like:

- Probability: How likely is the risk to occur?

- Severity: What’s the potential impact on the project?

- Detectability: How easily can the risk be detected and monitored?

- Mitigability: How easily can the risk be mitigated or controlled?

For example, they identify a high likelihood and high impact for the risk of “Delays in development”. This risk gets a high score, indicating that it requires immediate attention and mitigation strategies. ISO 31000

Analyzing and Prioritizing Risks: Focus on What Matters Most

Meet Maria, a seasoned risk manager at a financial institution in Lahore. She’s responsible for identifying and mitigating risks that could impact her organization’s bottom line. Maria knows that not all risks are created equal, and she needs to focus on the ones that matter most. ISO 31000

Risk Analysis: Digging Deeper

Maria takes the list of identified risks and conducts a thorough analysis of each one. She considers factors like:

- Risk likelihood: How probable is the risk?

- Risk impact: What’s the potential financial, reputational, or operational impact?

- Risk velocity: How quickly could the risk materialize?

- Risk proximity: How close is the risk to becoming a reality?

For example, Maria analyzes the risk of “Cyber Attack” and determines that:

- Likelihood: High (due to increased phishing attempts)

- Impact: High (potential data breach and financial loss)

- Velocity: Fast (can happen at any time)

- Proximity: Near (recent incidents in the industry)

Risk Prioritization: Focus on the Critical Few

Maria uses a risk matrix to prioritize the analyzed risks, focusing on the ones with the highest likelihood and impact. She identifies the top 3 critical risks that require immediate attention:

- Cyber Attack: High likelihood and high impact

- Market Volatility: Medium likelihood but high impact

- Regulatory Changes: High likelihood and medium impact

By prioritizing these critical risks, Maria can allocate resources effectively and develop targeted mitigation strategies to minimize their potential impact. She’ll monitor these risks closely, reviewing and updating her analysis regularly to ensure her organization stays ahead of potential threats. ISO 31000

Implementing Controls and Mitigation Strategies: Turning Risk Management into Action

Meet Ali, a risk management specialist at a manufacturing company in Faisalabad. He’s responsible for implementing controls and mitigation strategies to manage the risks identified in the previous stages. Ali knows that effective risk management is all about taking proactive steps to minimize potential threats. ISO 31000

Risk Mitigation Strategies: Reducing Risk to Tolerable Levels

Ali develops mitigation strategies for each of the prioritized risks, considering factors like:

- Risk avoidance: Eliminating the risk source

- Risk transfer: Shifting the risk to a third party (e.g., insurance)

- Risk reduction: Implementing controls to minimize risk impact

- Risk acceptance: Accepting the risk and monitoring it closely

For example, to mitigate the risk of a “Cyber Attack”, Ali implements the following strategies:

- Firewalls and antivirus software: Reduces the risk of malware attacks

- Employee training: Educates staff on phishing and data protection

- Regular backups: Ensures business continuity in case of data loss

- Incident response plan: Establishes a plan to respond quickly in case of a breach

Control Implementation: Turning Strategies into Action

Ali works with various departments to implement the mitigation strategies, ensuring that:

- Policies and procedures: Are updated to reflect new controls

- Training and awareness: Employees understand their roles in risk management

- Monitoring and review: Regular checks to ensure controls are effective

For instance, Ali collaborates with the IT department to install firewalls and antivirus software, and with the HR department to develop employee training programs. ISO 31000

Continuously Monitoring and Reviewing Risk Management Effectiveness: Staying Vigilant

Meet Sara, a risk management expert at a healthcare organization in Islamabad. She understands that risk management is an ongoing process, requiring continuous monitoring and review to ensure effectiveness. Sara knows that complacency can lead to devastating consequences. ISO 31000

Monitoring Risk Management Effectiveness: Keeping a Pulse on Risk

Sara regularly reviews key performance indicators (KPIs) and metrics to assess the effectiveness of risk management strategies. She tracks:

- Risk incident reports: Documenting and analyzing risk events

- Control effectiveness: Evaluating the success of implemented controls

- Risk appetite: Ensuring alignment with organizational objectives

- Stakeholder feedback: Gathering insights from employees, patients, and partners

For example, Sara monitors the effectiveness of infection control measures in the hospital by tracking:

- Infection rates: Comparing current rates to historical data

- Compliance with protocols: Ensuring staff adherence to infection control procedures

- Patient satisfaction: Gathering feedback on care quality and safety

Reviewing and Refining Risk Management Strategies: Adapting to Change

Sara conducts regular reviews of risk management strategies, considering:

- Changes in the risk landscape: Emerging risks, regulatory updates, and industry trends

- Organizational changes: Shifts in leadership, structure, or operations

- Lessons learned: Insights from risk incidents and near-misses

For instance, Sara refines the hospital’s emergency preparedness plan after a recent flood in the area, incorporating new protocols for: ISO 31000

- Emergency response: Streamlined communication and evacuation procedures

- Supply chain management: Ensuring critical medical supplies are stocked and accessible

- Staff training: Enhanced education on emergency response and crisis management

By continuously monitoring and reviewing risk management effectiveness, Sara’s organization stays vigilant, adapting to changing risks and ensuring the safety of patients, staff, and assets. In the next section, we’ll explore the importance of communication and consultation in risk management. ISO 31000

Ensuring Stakeholder Engagement and Communication: The Heart of Risk Management

Meet Javeria, a risk management specialist at a financial institution in Karachi. She understands that effective risk management requires collaboration and communication with stakeholders. Javeria knows that engaging stakeholders is crucial for identifying, assessing, and mitigating risks. ISO 31000

Stakeholder Identification: Who Needs to Be Involved

Javeria identifies key stakeholders, including:

- Employees: Frontline staff, managers, and executives

- Customers: Individuals and businesses impacted by risk decisions

- Regulators: Government agencies and industry watchdogs

- Investors: Shareholders and stakeholders with a financial interest

Communication Strategies: Reaching Stakeholders Effectively

Javeria develops tailored communication strategies to engage stakeholders, including:

- Regular risk reports: Providing transparent and concise updates on risk management activities

- Training and awareness programs: Educating stakeholders on risk management principles and practices

- Surveys and feedback mechanisms: Encouraging stakeholder input and suggestions

- Collaborative workshops: Fostering open discussion and problem-solving among stakeholders

For example, Javeria organizes a workshop with employees to discuss potential operational risks and gather feedback on mitigation strategies. She also provides regular risk reports to regulators and investors, ensuring transparency and accountability. ISO 31000

Stakeholder Engagement: Building Trust and Partnerships

Javeria builds strong relationships with stakeholders, ensuring that:

- Risk management is integrated into daily operations

- Stakeholders feel heard and valued

- Collaborative problem-solving is encouraged

By engaging stakeholders and communicating effectively, Javeria’s organization fosters a culture of risk management, ensuring that everyone is working together to achieve common goals. In the next section, we’ll explore the importance of continuous improvement in risk management. ISO 31000

Embedding a Culture of Continuous Improvement in Risk Management: Empowering Progress

Meet Tahir, a risk management leader at a technology company in Lahore. He recognizes that risk management is a continuous journey, requiring a culture of improvement to stay ahead of emerging risks. Tahir inspires his team to embrace a growth mindset, fostering an environment of learning and innovation. ISO 31000

Continuous Learning: Staying Ahead of Emerging Risks

Tahir encourages his team to:

- Stay updated on industry trends and regulatory changes

- Attend webinars and conferences to expand your knowledge

- Share best practices and lessons learned

For example, Tahir’s team attends a workshop on artificial intelligence and machine learning, exploring potential risks and opportunities for their organization. ISO 31000

Experimentation and Innovation: Testing New Approaches

Tahir empowers his team to:

- Design and conduct experiments to test new risk management approaches

- Collaborate with cross-functional teams to leverage diverse perspectives

- Embrace failure as an opportunity for growth and learning

For instance, Tahir’s team developed a proof-of-concept for a new risk assessment tool, testing its effectiveness and refining its design based on feedback.

Recognition and Rewards: Celebrating Progress and Success

Tahir acknowledges and celebrates team achievements, recognizing:

- Individual contributions to risk management efforts

- Team successes in mitigating risks and achieving goals

- Innovative solutions and creative problem-solving

By embedding a culture of continuous improvement, Tahir’s organization stays agile and proactive, ensuring that risk management is an integral part of their DNA. In the next section, we’ll explore the importance of leadership commitment to risk management. ISO 31000